How to Build a Winning Forex Trading Strategy

Please Wait...

How to Build a Winning Forex Trading Strategy

Alright, let’s cut straight to it — you’re here to figure out how to actually win in forex. Not just mess around and hope for the best, but build something that makes sense, holds up under pressure, and maybe — just maybe — helps you walk away with some real gains. Cool. Let’s break it down.

Why you even need a strategy in forex

Jumping into forex with no plan? That’s like driving blindfolded. Sure, you might make it down the road, but odds are you’re gonna crash — hard. A trading strategy keeps you grounded. It’s your playbook. Your GPS. Without one, you're just reacting, not trading.

Start with your vibe: what kind of trader are you?

Every good forex strategy starts with knowing your own style. You more of a chill, slow-and-steady kinda trader? Or you love that quick action, in and out in minutes? Figure this out:

-

Scalping – super short-term. You’re in the game for minutes, max. Fast trades, tiny profits, repeat all day.

-

Day trading – you open and close trades within the same day. No overnight stress.

-

Swing trading – ride the waves. Hold for days or even weeks. Catch bigger moves.

-

Position trading – long-haul type. You’re holding for weeks, maybe months. You want the big picture plays.

Know your type — it shapes the whole strategy.

Pick your tools, not toys

Now you’re gonna need indicators. But hey — don’t go indicator crazy. You don’t need 8 indicators yelling at you at once. Pick a couple that make sense:

-

Moving Averages – helps smooth out price action. Gives you a sense of direction.

-

RSI – tells you when things are overbought or oversold.

-

MACD – momentum + trend combo. Solid tool.

-

Support & Resistance – not exactly indicators, but they’re gold. They show where price might bounce or break.

Just make sure whatever you use actually fits your trading style. Don’t copy someone else’s setup just 'cause it looks cool on YouTube.

Let’s talk entries — when do you jump in?

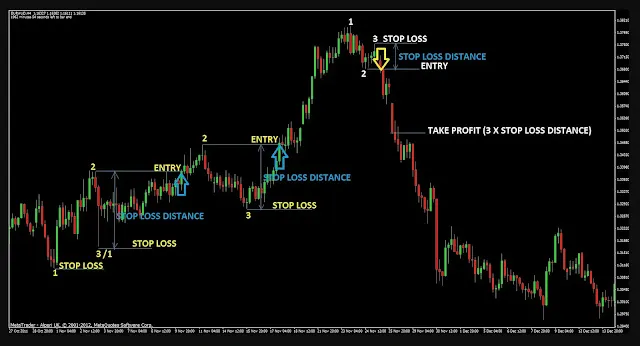

This part’s where the magic happens. You need rules for entry. Real ones. Not “I feel like it.”

Set triggers. Maybe it’s when a moving average crosses. Maybe you wait for a candlestick pattern at support. Doesn’t matter what — it just needs to be consistent. No guessing. No gambling.

Now — when do you get OUT?

This right here separates traders from dreamers. You gotta have a plan to exit — win or lose.

-

Stop loss – non-negotiable. This keeps you alive. Decide the max you’ll lose before you open the trade.

-

Take profit – aim for a level where you’ll cash out. Don’t get greedy. Stick to the plan.

And yeah — sometimes price hits neither and just goes sideways. That’s cool. You can always manually close if things look sketchy.

Risk management ain’t sexy, but it’s everything

Wanna know the real secret to winning at forex? Don’t blow your account. That’s it. Manage your risk like your trading life depends on it — ‘cause it does.

Some solid habits:

-

Never risk more than a small chunk of your account per trade. We’re talking like 1% or less.

-

Don’t revenge trade. Lose a trade? Cool. Step back. Breathe.

-

Watch that leverage. High leverage is tempting but dangerous. Be careful.

Backtest like your future self depends on it

Once you’ve got your setup, you gotta test it. Don’t just go live with your hard-earned cash on some strategy you threw together last night. Go back through the charts. Run the numbers. See how it would've worked in the past.

Then test it forward — in a demo account. Not forever, but long enough to feel confident.

Keep a trading journal. No, really.

Most folks skip this part, but it’s where real growth happens. Write down every trade — the why, the how, the result, what you felt. Over time, you’ll start to see patterns. Mistakes. Wins. Stuff you can tweak.

It’s not just about what you trade. It’s about learning how you trade.

Adapt. Or get left behind.

Markets change. News happens. Your strategy needs to breathe. That doesn’t mean chasing every new trend — but be flexible. If your strategy’s losing over and over, figure out why. Adjust. Don’t be stubborn.

Your mindset matters. A lot.

Even the best strategy can’t save you if your head’s not right. You’ve gotta stay cool under pressure. No FOMO. No panic. Patience is a weapon in forex.

Some mindset reminders:

-

You will lose trades. Everyone does. It’s part of the game.

-

Stick to your rules, even when it’s boring.

-

Don’t trade just to feel busy.

-

Take breaks. Walk away. Reset.

To wrap it up...

Building a forex strategy that actually works isn’t about magic formulas or secret hacks. It’s about clarity. Knowing who you are as a trader, picking tools that fit you, and following a process with discipline.

There’s no one-size-fits-all. What works for someone else might flop for you. So test. Tweak. Learn. And most of all — stick with it. Because the truth is, consistency beats perfection every single time in forex.